What is a Medicare supplement and why do I need one?

A Medicare supplement, also known as a Medigap plan, fills in some of the gaps in your Medicare hospital (Part A) and medical (Part B) coverage. When you receive Medicare-covered services, Medicare pays first, then the supplement pays some or all of the remaining costs. The nice thing about a supplement is that there are no network restrictions – you can go to any doctor or hospital that accepts Medicare, and no referrals are required.

There are ten standardized Medicare supplement plans, which means that a Plan F from one insurance company, for instance, will cover the same expenses as a Plan F from another insurance company. When you first sign up for Medicare Part B, regardless of age, you have 6 months to purchase a Medicare supplement without answering any medical questions; after that, any application or changes you want to make may require medical approval.

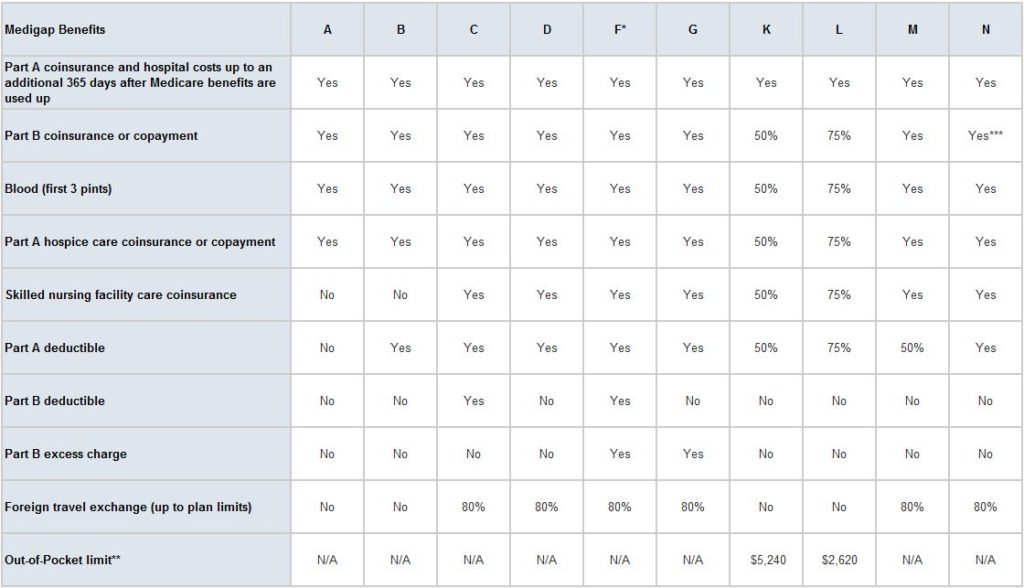

Compare Medigap plans side-by-side

The chart below shows basic information about the different benefits Medigap policies cover. While there are 10 standardized plans, not all plans are available in every state and most insurers do not offer every plan. All of our clients have selected plan F or plan G, and that’s what we’re likely to recommend if you’re interested in a Medicare supplement.

Yes = the plan covers 100% of this benefit

No = the policy doesn’t cover that benefit

% = the plan covers that percentage of this benefit

N/A = not applicable

* Plan F also offers a high-deductible plan. If you choose this option, this means you must pay for Medicare-covered costs up to the deductible amount of $2,240 in 2018 before your Medigap plan pays anything.

** After you meet your out-of-pocket yearly limit and your yearly Part B deductible, the Medigap plan pays 100% of covered services for the rest of the calendar year.

*** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in inpatient admission.

Source: https://www.medicare.gov/supplement-other-insurance/compare-medigap/compare-medigap.html

How to Avoid the 3 Most Common Mistakes when Selecting a Medicare Plan

A Free, no-obligation workshop that details the Medicare enrollment process.

Medicare Emrollment Workshop

We will address all the confusion of medicare insurance you hear from friends, family and the national media.

We will explain the hidden costs of a medicate policy and detail what you can expect to pay on an annual basis.

We will explore all the medicare options available to you and help you find the program that best fits your life situation.